The digital age has brought a revolution in the financial sector, providing consumers with versatile and convenient financial products. One such exemplary addition is the Bajaj Finance EMI Card App; your key to no cost EMI shopping. But first, let’s understand what no cost EMI means.

Understanding No Cost EMI

No Cost EMI is a term that deals with the payment aspect, No Cost EM means that when you make a purchase using this scheme, you do not pay any extra cost or interest on the product. In short, you only pay the actual price of the product in installments. As such, No Cost EMI provides you with financial flexibility, allowing you to make purchases without worrying about interest rates or hidden charges.

Benefits of Bajaj Finance EMI Card App

The Bajaj Finance EMI Card App is an excellent tool that takes this concept further, providing consumers with a hassle-free and digitized option of availing No Cost EMI on a wide range of products. This app not only simplifies your shopping experience but also enhances your financial potential with various benefits.

Extensive Network of Partner Stores

The Bajaj Finance EMI card delivers a multitude of advantages that are designed to simplify the purchasing process for its users. One remarkable feature is the extensive network of partner stores across the country, catering to multiple product categories including electronics, furniture, home appliances, clothing, and more.

Pre-Approved Loan Limit

Another advantage is the pre-approved loan limit. As a Bajaj Finance EMI Card holder, you have a pre-approved loan limit that you can use to make purchases on the go. The loan limit varies from customer to customer, depending on their credit score and repayment abilities.

No Cost EMI Shopping Feature

Most striking is the no cost EMI shopping feature. With the Bajaj Finance EMI Card App, you can convert the price of your product into easy, interest-free EMIs. This means you only pay the price of the product, divided equally over the loan tenure without any extra charges.

Additionally, the Bajaj Finserv Insta EMI Card comes with added benefits. It saves your time with instant loan approval, allowing you to make quick purchases. Plus, it gives you exclusive offers during various sale events, making your shopping experience more beneficial.

Applying for the Bajaj Finance EMI Card

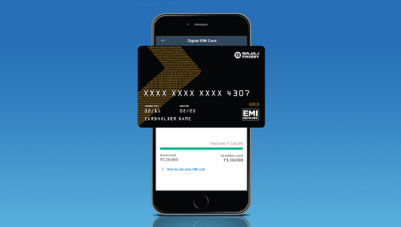

Applying for the Bajaj Finance EMI Card is straightforward and can be done through the app itself. You need to download the Bajaj Finserv Wallet app, register using your mobile number and follow the instructions provided to apply for the EMI Network Card. You will need your Aadhaar Card and PAN Card for the application. You will also be asked to pay a nominal joining fee. After your application is approved, a Digital EMI Network Card will be sent to your Bajaj Finserv Wallet.

Using the Bajaj Finance EMI Card

After receiving your card, you can use it to make purchases online or at a store. Simply choose the product you wish to buy, select ‘Bajaj Finserv EMI’ as your payment option, choose the EMI plan that suits your budget, and finally, enter your EMI Network Card details to complete the transaction.

For online purchases, you can also use the ‘cardless’ feature of the Bajaj Finance EMI Card App. You just need to authenticate your purchase using an OTP sent to your registered mobile number.

Trusted by over million of customers in India, the Bajaj Finserv App meets all your financial and payment needs. Download Bajaj Finserv App to apply for loans, shop 1 million+ products at no-cost EMI, manage investments, get insurance, pay utility bills, recharge services, and transfer money using BHIM UPI. Experience seamless financial management today!

Conclusion

In conclusion, the Bajaj Finance EMI Card App is an exceptional financial tool that provides convenient and affordable shopping options. Its no cost EMI feature and other unique benefits make it a true game-changer in the digital financing industry. Whether you are planning to buy a new gadget or need to upgrade your home appliances, the Bajaj Finance EMI Card App has got you covered. It’s time to get shopping done smarter with Bajaj Finserv!