Managing a small business is no small feat. From balancing the books to keeping employees happy, every detail counts. One often overlooked yet critical aspect of running a business is payroll management. Accurate paystubs are not just essential for compliance but also play a crucial role in employee satisfaction and business organization. That’s where a paystub creator comes into play.

In this blog, we’ll explore how paystub creators can streamline your small business operations, ensuring better organization and efficiency while meeting compliance standards.

What is a Paystub Creator?

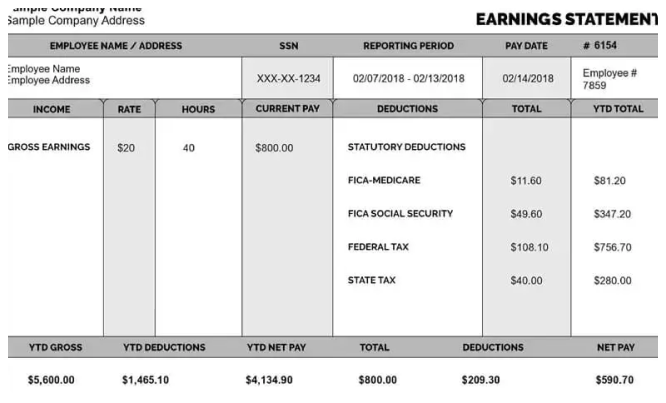

A paystub creator is an online tool or software designed to generate detailed, professional paystubs. These documents summarize an employee’s earnings, deductions, and net pay for a given period. They also provide essential details like tax withholdings, benefits contributions, and overtime hours.

With a Free pay stub creator, small businesses can automate payroll documentation without the need for expensive software or third-party payroll services.

Why Small Businesses Need Paystubs

Many small businesses underestimate the importance of paystubs. However, these documents are vital for several reasons:

- Employee Transparency

Paystubs ensure employees understand how their wages are calculated. A detailed paystub shows earnings, deductions, and taxes, leaving no room for confusion. - Legal Compliance

Most states in the U.S. require businesses to provide employees with paystubs. Non-compliance can lead to fines and legal issues. - Record Keeping

Paystubs help employers and employees maintain accurate financial records. This is critical for tax filings, audits, and financial planning. - Employee Trust

Providing professional paystubs demonstrates that a business values transparency and professionalism, fostering trust among employees.

How a Paystub Creator Helps Small Businesses Stay Organized

1. Simplifies Payroll Management

Small business owners often wear many hats, and handling payroll can be time-consuming. A paystub creator simplifies this process. With pre-designed templates and automation features, these tools allow you to generate paystubs in minutes.

For example, you only need to input basic employee details, hours worked, and salary information. The software calculates taxes, deductions, and other financial data automatically, ensuring accuracy.

2. Ensures Compliance with Labor Laws

Labor laws in the U.S. vary from state to state. A paystub creator helps businesses stay compliant by including all mandatory information on paystubs, such as gross pay, deductions, net pay, and employer details.

Some paystub creators are even updated with the latest tax laws and regulations, ensuring your documents meet state and federal requirements.

3. Reduces Errors

Manual payroll calculations are prone to mistakes, which can lead to financial discrepancies and employee dissatisfaction. A paystub creator reduces the risk of errors by automating calculations.

For example, it can account for:

- Overtime pay

- Bonuses

- State and federal tax deductions

- Social Security and Medicare contributions

This level of precision helps maintain accurate records and avoids costly payroll errors.

4. Cost-Effective Solution

Hiring a payroll service or accountant can be expensive for small businesses. A paystub creator is a budget-friendly alternative. Most tools offer affordable subscription plans or even free options with basic features.

By saving money on payroll services, small businesses can allocate their resources to other critical areas, such as marketing or employee development.

5. Improves Record Keeping

Keeping track of payroll records is crucial for tax filings, audits, and financial planning. A paystub creator stores digital copies of all paystubs, making it easy to access records whenever needed.

This eliminates the hassle of maintaining physical files and ensures you’re prepared for any audits or employee inquiries.

6. Enhances Employee Satisfaction

Employees appreciate clear, professional paystubs. A paystub creator provides detailed, easy-to-read paystubs, which help employees understand their earnings and deductions.

Happy employees are more likely to be productive and loyal, reducing turnover rates and improving workplace morale.

Key Features to Look for in a Paystub Creator

When choosing a paystub creator for your small business, consider the following features:

- User-Friendly Interface

Look for a tool that is easy to navigate, even if you have limited technical skills. - Customization Options

A good paystub creator allows you to customize templates with your business name, logo, and specific pay details. - Accurate Calculations

Ensure the tool can handle various payroll scenarios, including overtime, bonuses, and multiple tax deductions. - Cloud Storage

Opt for a paystub creator that offers secure digital storage for easy record-keeping and access. - Affordable Pricing

Many paystub creators offer tiered pricing plans, allowing you to choose one that fits your budget.

How to Use a Paystub Creator

Using a paystub creator is straightforward. Here’s a step-by-step guide:

- Choose a Paystub Creator

Select a reliable paystub creator that meets your business needs. Popular options include online platforms like PayStubCreator.net and StubCreator.com. - Enter Employee Details

Input basic information such as the employee’s name, address, and job title. - Provide Payment Information

Add details like hourly rate, salary, hours worked, and payment frequency (e.g., weekly, bi-weekly, or monthly). - Include Deductions

Input tax withholdings, benefits deductions, and any other relevant financial information. - Generate and Save

Once all details are entered, generate the paystub and save it digitally or print a physical copy.

Examples of Small Business Scenarios Where a Paystub Creator Helps

1. Seasonal Businesses

For businesses with fluctuating staff, such as retail stores during the holiday season, a paystub creator ensures payroll remains accurate and organized.

2. Freelancers and Contractors

If your business hires freelancers or contractors, you can use a paystub creator to provide them with professional payment documentation.

3. Growing Teams

As your business expands and hires more employees, a paystub creator can scale with you, ensuring consistent payroll processes.

Conclusion

Staying organized is crucial for the success of any small business, and payroll is a big part of that. A paystub creator simplifies payroll management, reduces errors, ensures compliance, and improves employee satisfaction.

By investing in a reliable paystub creator, small business owners can save time, money, and stress while focusing on growing their business. Whether you’re managing a small team or a seasonal workforce, this tool can make a big difference in your operations.

Take the first step toward better organization and efficiency by exploring paystub creators today. Your business—and your employees—will thank you!

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season