In today’s fast-paced world, managing finances efficiently is crucial, whether you’re a freelancer, small business owner, or employee. One key element in keeping your financial records accurate and transparent is having access to professional check stubs. However, not everyone has the time or expertise to generate them manually. That’s where a free check stub maker comes in.

A check stub maker is an online tool that simplifies the process of creating professional and accurate pay stubs quickly. Whether you need to track your earnings or provide proof of income for a loan or rental application, a check stub maker helps streamline the process. In this blog, we’ll explore how to create check stubs in minutes using these tools, and we’ll discuss why they are a vital tool for individuals and businesses alike.

What is a Check Stub?

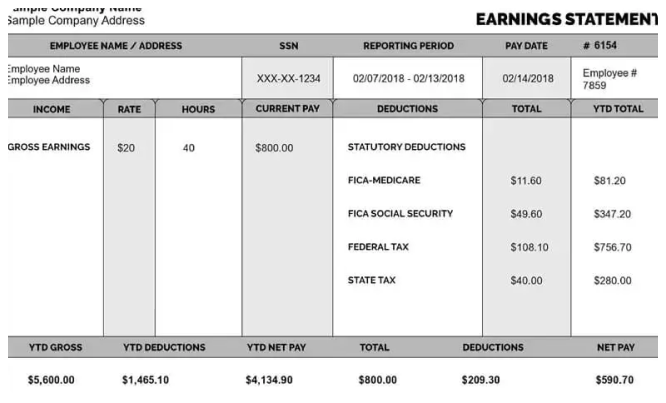

A check stub, also known as a pay stub or paycheck stub, is a document that accompanies a paycheck and details the earnings and deductions from an employee’s pay. It shows the gross income, taxes withheld, deductions for benefits, and net pay (the amount the employee takes home).

For business owners, providing employees with accurate check stubs is essential for maintaining transparency and legal compliance. For employees or freelancers, a check stub is a crucial tool for budgeting, tax filing, and applying for loans or credit.

However, generating check stubs manually can be a time-consuming and error-prone process. That’s where a check stub maker becomes invaluable.

Why Use a Check Stub Maker?

Here are some of the key reasons why using a check stub maker can benefit you:

- Saves Time: Rather than spending hours creating check stubs manually or relying on accounting professionals, a check stub maker lets you generate pay stubs in just a few minutes.

- Accuracy: By using a check stub maker, you can avoid common mistakes like incorrect calculations of taxes or benefits. These tools are designed to ensure that your check stubs are accurate and in line with current tax laws and payroll regulations.

- Professional Quality: Many check stub makers offer professionally designed templates that look clean and official. This is important if you need to provide your pay stubs to lenders, landlords, or financial institutions.

- Customizable: Most check stub makers allow you to customize the check stub details, including the company name, employee information, pay period, deductions, and more.

- Secure and Confidential: Check stub makers ensure that all the data entered remains confidential and secure. No need to worry about manual documents being lost or mishandled.

- Affordable: Creating check stubs manually or using payroll services can be expensive. Many online check stub generators offer affordable or even free options to suit different needs.

Steps to Create a Check Stub Using a Check Stub Maker

Creating a professional check stub with an online check stub maker is straightforward. Here’s how you can do it in just a few simple steps:

Step 1: Choose a Reliable Check Stub Maker

The first step is to select a trustworthy check stub maker. There are numerous tools available online, but it’s important to choose one that is user-friendly and has a reputation for reliability and security. Some check stub makers offer free versions with basic features, while others have premium plans that unlock more advanced features.

Step 2: Enter Your Company and Employee Information

Once you’ve chosen your check stub maker, the next step is to input the relevant details. This includes:

- Company Information: Your business name, address, phone number, and tax ID (if applicable).

- Employee Information: The employee’s name, address, Social Security number (if applicable), and job title.

- Pay Period: Specify the start and end dates of the pay period (weekly, bi-weekly, monthly, etc.).

- Pay Date: Enter the date the paycheck is issued.

Step 3: Add Earnings and Deductions

Next, you’ll need to input the details of the employee’s earnings and deductions. This is where a check stub maker truly shines, as it helps you calculate everything with ease.

- Gross Pay: This is the employee’s total earnings before deductions, including salary, hourly wages, bonuses, and overtime.

- Deductions: You can enter deductions for federal and state taxes, Social Security, Medicare, insurance premiums, retirement contributions, and other benefits.

- Net Pay: The check stub maker will automatically calculate the net pay (the amount the employee takes home after deductions) based on the information you input.

Step 4: Review and Customize the Layout

Before finalizing the check stub, take a moment to review all the details and make sure everything is accurate. Most check stub makers allow you to customize the layout and design to suit your preferences. You can:

- Choose from various template designs.

- Add logos or customize colors.

- Include additional details like overtime or commission if needed.

Step 5: Generate and Download the Check Stub

Once you’re satisfied with the information and design, hit the “Generate” button to create the check stub. The check stub maker will produce a digital version that you can download, print, or email directly to the employee.

Step 6: Store and Distribute the Check Stubs

Finally, you can store the check stubs for your records or send them to the employee. Many check stub makers offer an option to store check stubs securely in your online account, making it easier to access them in the future.

Benefits of Using a Check Stub Maker for Business Owners

For business owners, a check stub maker is more than just a time-saver. It’s an essential tool for managing payroll efficiently and ensuring compliance. Here are some additional benefits:

- Compliance: By using a check stub maker, you ensure that your pay stubs comply with federal and state payroll regulations. This can help avoid legal issues and fines related to payroll errors.

- Easy Record-Keeping: Check stub makers automatically generate accurate records of your payroll history. This simplifies accounting and makes tax time a lot easier.

- Employee Trust: Providing employees with professional, clear, and accurate check stubs helps build trust. Employees feel confident knowing their pay is correctly calculated and documented.

- Remote Access: Many check stub makers are cloud-based, meaning you can create and manage pay stubs from anywhere. This is particularly useful for businesses with remote employees or multiple locations.

- Tax Preparation: Accurate check stubs make tax preparation a breeze. When it’s time to file taxes, you can easily access the necessary information, including earnings and tax withholdings.

Using a Check Stub Maker for Personal Use

Even if you’re not a business owner, you can still benefit from using a check stub maker. Freelancers, contractors, and even employees can use check stub makers to track their earnings and deductions.

For example, if you’re a freelancer, a check stub maker allows you to create professional pay stubs to show proof of income when applying for loans, mortgages, or apartments. This can make the difference in getting approved for financial assistance.

A check stub maker is also helpful for organizing your finances. You can use the check stubs to better understand your income, track deductions, and plan your budget accordingly.

Things to Keep in Mind When Using a Check Stub Maker

While a check stub maker can simplify the process of creating check stubs, it’s important to use it correctly to avoid common mistakes:

- Accuracy: Double-check the information you input, especially when it comes to earnings and deductions. Mistakes can lead to discrepancies in your financial records.

- Security: Use a check stub maker that offers encryption and secure storage of your data. Your financial information should always be protected.

- Tax Updates: Ensure that the check stub maker you use is updated with the latest tax rates and payroll regulations. This ensures that your pay stubs are always accurate and compliant.

Conclusion

In conclusion, creating professional check stubs has never been easier with the help of a check stub maker. Whether you’re a business owner looking to streamline payroll or an individual needing to track your income, this tool saves you time, reduces errors, and provides a professional result.

By following the simple steps outlined in this blog, you can create accurate, customized check stubs in minutes, making financial record-keeping and tax preparation a whole lot easier. So, why spend time manually creating pay stubs when you can use a check stub maker to do the hard work for you? Try one today and experience the convenience and professionalism it offers.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season