Global Wind Turbine Rotor Blade Industry: Key Statistics and Insights in 2024-2032

Summary:

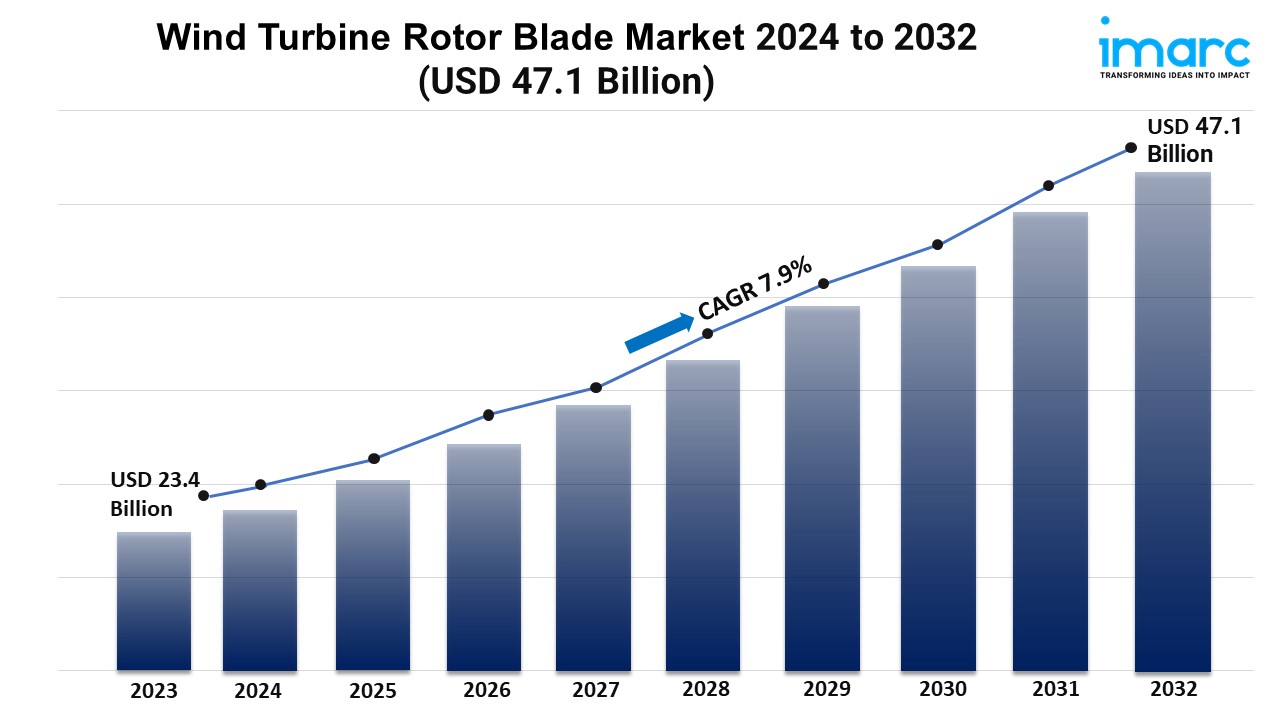

- The global wind turbine rotor blade market size reached USD 23.4 Billion in 2023.

- The market is expected to reach USD 47.1 Billion by 2032, exhibiting a growth rate (CAGR) of 7.9% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest wind turbine rotor blade industry share.

- Carbon fiber holds the majority of the market share in the blade material segment due to its lightweight properties that assist in reducing the load on turbine structures.

- 45-60 meters exhibit a clear dominance in the wind turbine rotor blade industry.

- Offshore remains a dominant segment in the market, allowing for the installation of larger turbines in the vast open sea areas.

- The rising demand of renewable energy is a primary driver of the wind turbine rotor blade market.

- Technological advancements are reshaping the wind turbine rotor blade market.

Industry Trends and Drivers:

- Rising renewable energy demand:

The need for wind energy infrastructure is being bolstered by global environmental legislation and renewable energy objectives. As a result, more wind farms are being built, which is driving market expansion. Large-scale onshore and offshore wind farms are seeing an increase in investment as a result of the increased emphasis on renewable energy. Larger and more sophisticated rotor blades are needed for these projects in order to maximize efficiency and energy extraction. Furthermore, nations want to lessen their reliance on fossil fuels, and wind energy is a good substitute. Wind turbines are becoming a vital component of the energy portfolio due to the rising need for cleaner energy, which is fueling the need for rotor blades to support the sector’s growth.

- Increasing global energy consumption:

Wind power is one of the sustainable and alternative energy sources that are becoming more and more in demand due to the world’s rising energy consumption. Wind energy is emerging as a practical solution to the world’s expanding energy needs. More power generation is required when energy demand rises. In order to fulfill energy demands, this is propelling the growth of wind farms, both onshore and offshore. Larger rotor blades are becoming more and more necessary to optimize energy generation as wind energy production capacity increases.

- Technological advancements:

Production of bigger rotor blades, which can collect more wind and produce more power, is made possible by technological advancements in materials and designs. For offshore wind farms, where bigger blades may capture faster wind speeds and boost total energy production, this is particularly crucial. In addition, rotor blade efficiency is increasing due to the development of stronger and lighter materials including carbon fiber, sophisticated composites, and long-lasting resins. By enabling durable blades that can resist harsh weather, these materials are extending the life of wind turbines and lowering maintenance costs.

Request for a sample copy of this report: https://www.imarcgroup.com/wind-turbine-rotor-blade-market/requestsample

Wind Turbine Rotor Blade Market Report Segmentation:

Breakup By Blade Material:

- Carbon Fiber

- Glass Fiber

- Others

Carbon fiber accounts for the majority of shares as it offers superior strength-to-weight ratio and stiffness as compared to traditional materials like fiberglass.

Breakup By Blade Length:

- Below 45 Meters

- 45-60 Meters

- Above 60 Meters

45-60 meters dominate the market on account of their ability to offer a balance between energy capture efficiency and logistical feasibility.

Breakup By Location of Deployment:

- Onshore

- Offshore

Onshore represents the majority of shares due to its lower installation and maintenance costs.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position owing to a large market for wind turbine rotor blade driven by favorable government initiatives.

Top Wind Turbine Rotor Blade Market Leaders:

The wind turbine rotor blade market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Acciona S.A.

- Enercon GmbH

- INOX Wind Limited

- LM Wind Power (General Electric Company)

- Moog Inc.

- Nordex SE

- SGS S.A.

- Siemens Gamesa Renewable Energy S.A. (Siemens Energy AG)

- Suzlon Energy Limited and Vestas Wind Systems A/S.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163